Gifts of Stock

Each year, we sincerely appreciate your gift of a cash donation before December 31st, and 2024 is no different. Alternatively, if you have enjoyed financial gains from stocks, bonds, or mutual funds, you may want to donate those financial gains instead before the year’s end. Why? Because you not only receive tax benefits when you donate appreciated securities, you also receive an income tax deduction and may avoid capital gains while helping to support the library.

To donate a stock gift to Milwaukee Public Library Foundation, we advise that you contact your financial institution/broker and use that institution’s stock transfer form. Please use the following information to facilitate stock gifts to the Milwaukee Public Library Foundation:

Milwaukee Public Library Foundation DTC#: 992

Account #: 61-0464-018

If you have questions about your stock gift to Milwaukee Public Library Foundation, please call Ryan Grall, Midwest Institutional Trust Services at (414) 255-1984.

Gifts From Your IRA

Retirees over the age of 70 ½ (or 72 for some due to changes in the new law) who don't wish to take the taxable required minimum distribution are able to donate up to $100,000 of their distribution to help Milwaukee Public Library Foundation. While income tax is normally due on each traditional IRA distribution, the account owner does not need to pay taxes on the amount donated to Milwaukee Public Library Foundation. To donate a gift from your IRA to Milwaukee Public Library Foundation, we advise that you contact your financial institution/broker.

You can also name Milwaukee Public Library Foundation as the beneficiary of a life insurance policy, donor-advised fund, commercial annuity, or bank and brokerage account.

Support Your Community

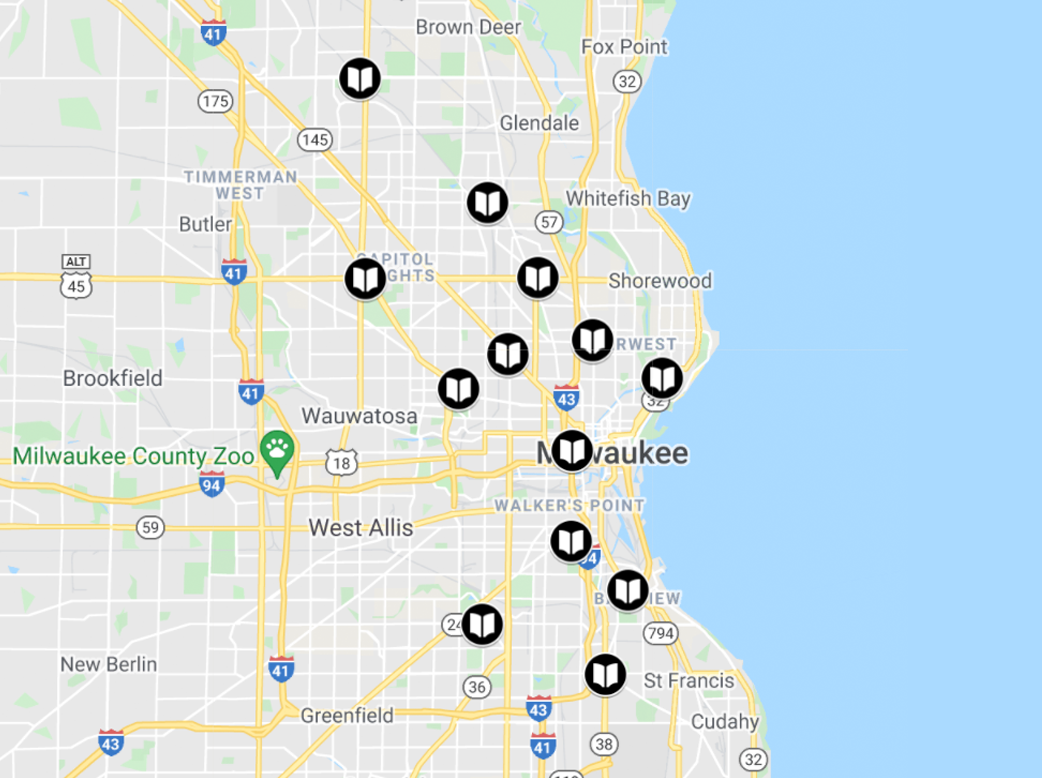

Our Milwaukee Public Libraries inspire imagination, strengthen neighborhoods, open opportunities, and nurture lifelong learning.

Your support makes it all possible.